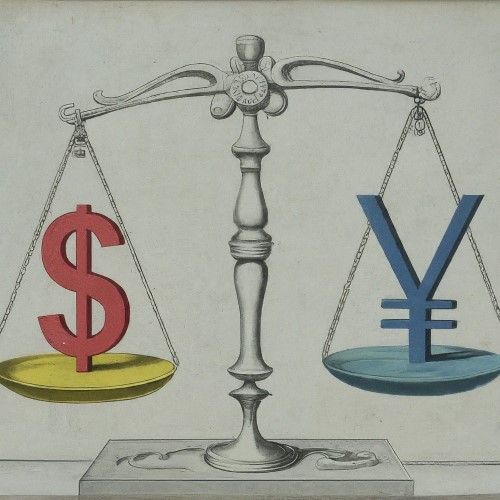

USD/JPY Gains Momentum, AUD/USD Faces Resistance

USD/JPY Gains Momentum, AUD/USD Faces Resistance

As the week unfolds, the forex market is witnessing a notable shift in momentum. The Japanese Yen (JPY) is coming under pressure against the US Dollar (USD), while the Australian Dollar (AUD) is struggling to break through a key resistance level.

USD/JPY: A Bullish Surge

The USD/JPY pair has been on a consistent upward trajectory in recent trading sessions. This surge can be attributed to several factors, including:

- Yield Differential: The widening interest rate differential between the United States and Japan continues to favor the USD.

- Risk Appetite: A generally positive global risk sentiment has also bolstered the greenback’s appeal.

- Yen Weakness: The JPY’s weakness is further exacerbated by the Bank of Japan’s ongoing monetary easing policies.

As the USD/JPY pair climbs, traders are closely monitoring potential resistance levels that could hinder its ascent. A break above these levels could signal further gains for the US Dollar.

AUD/USD: A Familiar Hurdle

The AUD/USD pair is once again encountering resistance near its 0.6500 level. This psychological barrier has proven to be a formidable obstacle for the Australian Dollar.

Several factors are contributing to the AUD/USD’s struggle:

- China’s Economic Slowdown: Concerns about China’s economic growth have weighed on the Australian Dollar, as the country is a major trading partner.

- Commodity Price Fluctuations: Fluctuations in commodity prices, particularly iron ore and coal, can also impact the AUD, given Australia’s reliance on these exports.

- Interest Rate Differentials: The relative interest rate outlook between Australia and the United States is another factor influencing the AUD/USD exchange rate.

If the AUD/USD pair fails to break through the 0.6500 resistance level, it could face downward pressure. However, a successful break above this level could open the door for further gains.

Overall, the forex market remains dynamic, and traders should stay informed about economic indicators, geopolitical events, and central bank decisions that could impact currency movements.